TOURELLE LIFEBROKERS- HOW ACC CAN WORK FOR YOUR BUSINESS

CASE STUDY

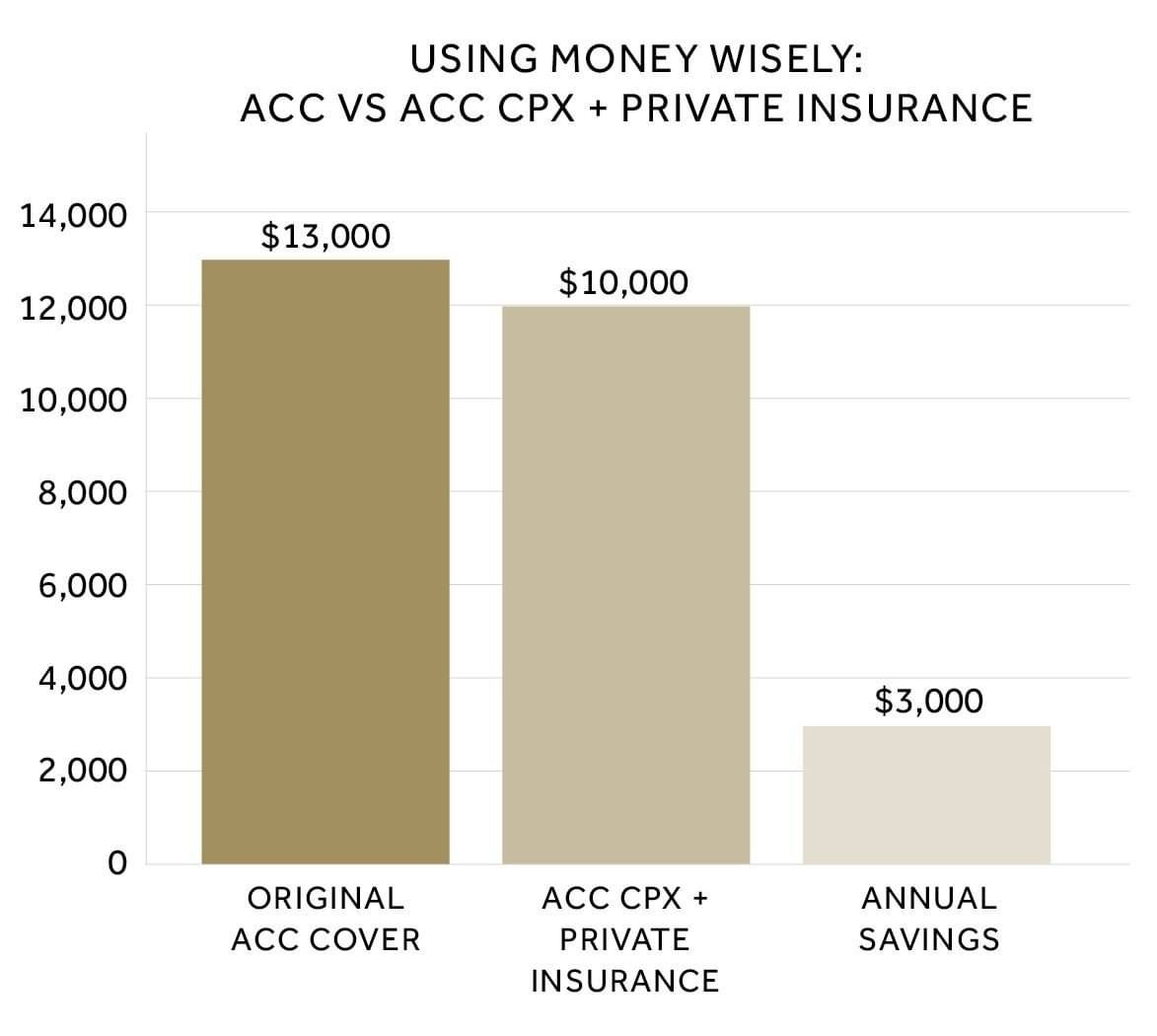

Husband and wife business owners paying themselves $75,000 each and paying ACC levies of $13,000. We restructured them both on CoverPlus extra for $7,000 ACC Levies (total). With the ACC savings of $6,000 they were able to insure their lives for $300,000 each have Trauma cover of $100,000 and Disability income of $4,000 per month each, for $3,000 per annum, insurance premiums. Total life insurance premiums and ACC levies $10,000 saving the client $3,000.

ACC only pays for accidents and if you have a (degenerative) disorder ACC can decline your weekly ACC compensation for your injury.

The secret is to contact us and get an ACC and insurance review. ACC combined with assurance products is a great combination, with most insurance covers non-cancellable with reoccurring injuries or illnesses.

THE GRAPH ABOVE ILLUSTRATES

Original ACC Levy: $13,000 per annum for the couple.

New Strategy (ACC CPX + Private Insurance): Total $10,000 per annum.

Annual Savings: $3,000.

KEY INSIGHTS

Key Insight:

By switching to ACC CoverPlus Extra and adding private insurance, the couple saved $3,000 annually and gained broader protection—including life, trauma, and income cover beyond injury-related compensation.

TAKE CONTROL OF YOUR ACC - AND YOUR INCOME

Talk to us about how CoverPlus Extra can give you better protection and peace of mind.